In theory, taxation is essentially coercive because taxes are never paid voluntarily. However, taxes are supposedly collected not only for purpose of collecting them but to finance public goods. Thus, consensual taxation is possible since private taxpayers desire public goods (the reason why they left the state of nature in the first place).

In comparing coercive and consensual or negotiated taxation, Michael Moore of the University of Sussex, not the controversial film-maker, argued that the latter constituted a better institutional technology. Coercive taxation (largely in agrarian societies) is relatively ineffective since it tends to generate resistance and because coercive tax collectors were well placed to pocket a large part of the proceeds for themselves. In contrast, consensual taxation offers (within the boundaries of individual states) joint gains for both rulers and taxpayers.

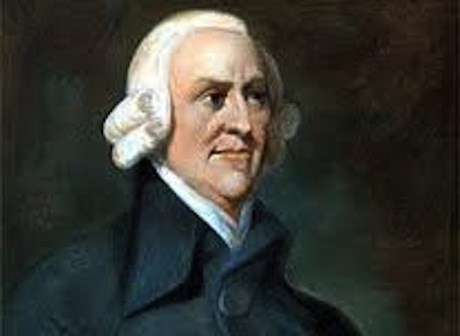

In the late 18th century, the idea that citizens must contribute to the upkeep of a state was developed. On of the political economists of the time, Adam Smith forwarded four maxims of taxation (equity, certainty, convenience, and efficiency). These maxim were also supported subsequently by David Ricardo and John Stuart Mill:

1. “The subjects of every state ought to contribute to the support of the government, as nearly as possible in proportion to their respective abilities: that is, in proportion to the revenue which they respectively enjoy under the protection of the state. In the observation or neglect of this maxim consists what is called the equality or inequality of taxation.

2. “The tax which each individual is bound to pay ought to be certain, and not arbitrary. The time of payment, the manner of payment, the quantity to be paid, ought all to be clear and plain to the contributor, and to every other person. Where it is otherwise, every person subject to the tax is put more or less in the power of the tax-gatherer, who can either aggravate the tax upon any obnoxious contributor, or extort, by the terror of such aggravation, some present or perquisite to himself. The uncertainty of taxation encourages the insolence and favours the corruption of an order of men who are naturally unpopular, even when they are neither insolent nor corrupt. The certainty of what each individual ought to pay is, in taxation, a matter of so great importance, that a very considerable degree of inequality, it appears, I believe, from the experience of all nations, is not near so great an evil, as a very small degree of uncertainty.

3. “Every tax ought to be levied at the time, or in the manner, in which it is most likely to be convenient for the contributor to pay it. A tax upon the rent of land or of houses, payable at the same term at which such rents are usually paid, is levied at a time when it is most likely to be convenient for the contributor to pay; or when he is most likely to have wherewithal to pay. Taxes upon such consumable goods as are articles of luxury are all finally paid by the consumer, and generally in a manner that is very convenient to him. He pays them by little and little, as he has occasion to buy the goods. As he is at liberty, too, either to buy or not to buy, as he pleases, it must be his own fault if he ever suffers any considerable inconvenience from such taxes.

4. “Every tax ought to be so contrived as both to take out and to keep out of the pockets of the people as little as possible over and above what it brings into the public treasury of the state. A tax may either take out or keep out of the pockets of the people a great deal more than it brings into the public treasury, in the four following ways. First, the levying of it may require a great number of officers, whose salaries may eat up the greater part of the produce of the tax, and whose perquisites may impose another additional tax upon the people.” Secondly, it may divert a portion of the labour and capital of the community from a more to a less productive employment. “Thirdly, by the forfeitures and other penalties which those unfortunate individuals incur who attempt unsuccessfully to evade the tax, it may frequently ruin them, and thereby put an end to the benefit which the community might have derived from the employment of their capitals. An injudicious tax offers a great temptation to smuggling. Fourthly, by subjecting the people to the frequent visits and the odious examination of the tax-gatherers, it may expose them to much unnecessary trouble, vexation, and oppression:” to which may be added, that the restrictive regulations to which trades and manufactures are often subjected to prevent evasion of a tax, are not only in themselves troublesome and expensive, but often oppose insuperable obstacles to making improvements in the processes.

To Adam Smith’s mind, bad governance is excessive taxation of capital and property. Not taxation per se, as he recognized the need for public goods and the role of the state in the provision of such goods. Bad governance discourages investment and owners of transportable assets can readily change domiciles to jurisdictions with acceptable tax burdens. Smith argued that a tax burden is acceptable to businessmen if the state is able to provide an equally acceptable bundle of public goods.

The views of David Ricardo and John Stuart Mill on taxation will be discussed in future blog posts.